Why is an appeal set for a single commissioner hearing?

The Chairperson of the Tax Equalization and Review Commission may designate any appeal for a single commissioner hearing when the taxable value of each parcel is $2 million or less as determined by the county board of equalization.

Can I request that my appeal be heard before the Commission instead of before a single commissioner?

Yes. Any party to an appeal designated by the Chairperson of the Tax Equalization and Review Commission for a hearing before a single commissioner may elect in writing, prior to a hearing, to instead have the appeal heard before the Commission.

What evidence can I bring to a single commissioner hearing?

A hearing held before a single commissioner is informal. There are no rules of evidence and the commissioner may consider any documents, testimony or statements at the hearing to make a determination. Parties are encouraged to bring three copies of each document to be considered; one for the commissioner, one for the other party, and one for the party presenting the document.

How do I appeal a single commissioner’s order?

After the commissioner issues an order, either party may request a rehearing of the appeal before the Commission. In order to request the rehearing a party must apply to the Commission for rehearing within thirty days of the date of the order issued by the single commissioner. This is not the date you receive the order in the mail, but the date the order is dated. The Commission may not rehear any appeal where the single commissioner dismissed the appeal because a party failed to appear at the single commissioner hearing. In no case can a single commissioner hearing be appealed directly to any court of law.

How do I appeal the decision of the Commission after a rehearing?

Anyone who wishes to appeal a final order of the Commission must follow the procedure outlined in Section 77- 5019 of Nebraska Statutes.

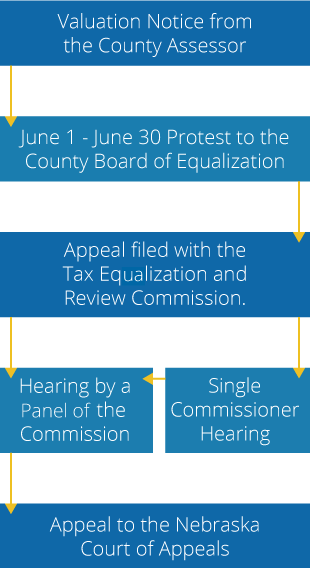

The Appeal Process